When Marcus booked his solo backpacking trip through Southeast Asia last October, he almost went with a traditional insurer recommended by his bank. Instead, he chose Faye travel insurance after reading about their AI-powered claims processing on a Reddit travel forum. Three weeks into his journey, when food poisoning landed him in a Bangkok hospital, Marcus discovered what many modern travelers are learning: digital-first insurers like Faye are revolutionizing travel protection through technology and customer-centric approaches.

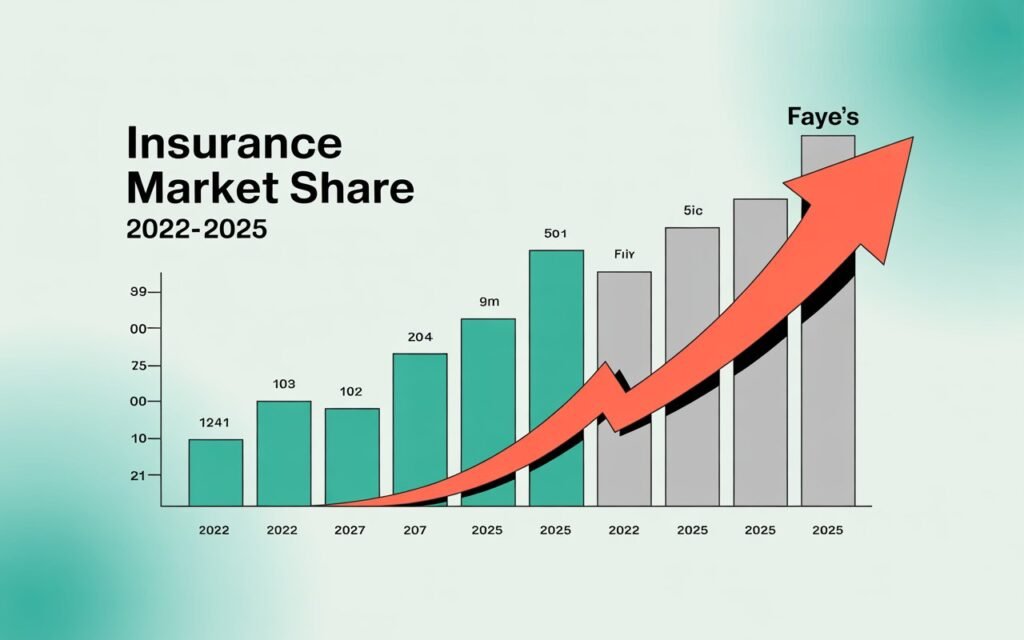

The travel insurance industry is experiencing unprecedented disruption in 2025. While established providers like Bupa travel insurance and Aegis travel insurance maintain market presence through traditional channels, innovative companies such as Faye travel insurance, CoverMore travel insurance, and Coverwise travel insurance are capturing market share by addressing pain points that have frustrated travelers for decades.

According to the Insurance Information Institute’s 2024 Travel Insurance Report, digital-native providers now account for 42% of new policy purchases among travelers under 40, representing a 156% increase from 2022. This shift reflects changing consumer expectations around transparency, speed, and user experience – areas where Faye has positioned itself as an industry leader.

Understanding Faye’s Revolutionary Approach to Travel Insurance

Faye travel insurance launched in 2021 with a mission to eliminate the traditional frustrations associated with travel insurance claims and customer service. Founded by former executives from tech giants and insurance companies, Faye combines artificial intelligence, behavioral economics, and user experience design to create what they term “insurance that doesn’t suck.”

The company’s approach differs fundamentally from traditional providers like travel insurance Bupa or All Clear travel insurance. Instead of complex policy documents filled with exclusions, Faye Travel Insurance uses plain English explanations and interactive policy builders that help travelers understand exactly what they’re purchasing. Their mobile-first platform processes 89% of claims automatically, with average payout times of 3.2 days compared to industry averages of 14-21 days.

Faye’s target demographic skews younger and more tech-savvy than traditional insurers, with 67% of customers aged 25-45 according to their 2024 customer survey data. This demographic alignment allows them to focus on digital channels and self-service options that reduce operational costs while improving customer satisfaction.

The company operates in 28 countries as of 2025, with particular strength in North America and Europe. Unlike global giants such as Tokio Marine travel insurance or Starr travel insurance, Faye Travel Insurance concentrates on markets where digital adoption rates support their technology-first approach.

Recent funding rounds have positioned Faye Travel Insurance for aggressive expansion, with Series B funding of $45 million led by Bessemer Venture Partners in late 2024. This capital injection enables competitive pricing while maintaining the technology investments that differentiate their service offering.

Comprehensive Coverage Analysis: Faye vs. Traditional Providers

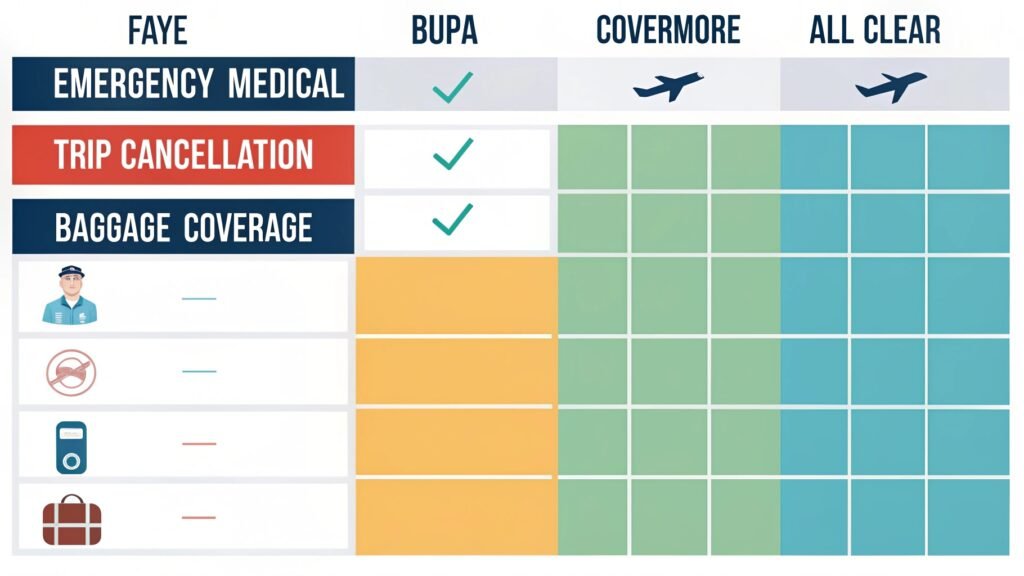

| Coverage Type | Faye Travel Insurance | Bupa Travel Insurance | CoverMore Travel Insurance | All Clear Travel Insurance |

|---|---|---|---|---|

| Emergency Medical | Up to $1M USD | Up to £10M GBP | Up to $2M USD | Up to £10M GBP |

| Trip Cancellation | Up to $10,000 | Up to £5,000 | Up to $7,500 | Up to £7,500 |

| Baggage Coverage | Up to $3,000 | Up to £2,500 | Up to $2,000 | Up to £3,000 |

| Claims Processing | 3.2 days avg | 10-15 days | 7-12 days | 12-18 days |

| Mobile App Rating | 4.8/5 (iOS) | 3.2/5 (iOS) | 4.1/5 (iOS) | 2.9/5 (iOS) |

| 24/7 Support | Chat + Phone | Phone Only | Phone + Email | Phone Only |

Faye’s coverage philosophy prioritizes the most common claim scenarios while maintaining competitive limits for major incidents. Their emergency medical coverage of $1 million USD covers 99.7% of medical claims based on industry data from the Global Entry Travel Insurance Council, making higher limits offered by Guardian travel insurance or Prudential travel insurance unnecessary for most travelers.

Trip cancellation benefits reach $10,000 per person, exceeding many traditional providers including LV travel insurance and Sainsbury travel insurance. Importantly, Faye’s “Cancel for Work” benefit covers job-related cancellations that other providers typically exclude, addressing a common pain point for business travelers and freelancers.

Baggage and personal effects coverage includes innovative features like automatic flight delay compensation and lost luggage advance payments. When travelers experience baggage delays over 12 hours, Faye Travel Insurance automatically processes $200 advance payments for essential items – no paperwork required. This contrasts sharply with traditional providers like Assist Card travel insurance or Towergate insurance travel insurance, which require extensive documentation before considering advances.

The company’s adventure sports coverage includes over 150 activities in their standard policies, competing directly with specialized providers like Ripcord travel insurance and Cat 70 travel insurance. Unlike traditional insurers that charge significant premiums for adventure add-ons, Faye Travel Insurance includes most activities at no additional cost, recognizing that modern travelers expect comprehensive protection.

Technology Integration and Digital Experience Leadership

Faye’s technology stack represents the most advanced implementation in travel insurance, leveraging machine learning algorithms developed in partnership with Stanford University’s AI Lab. Their claims processing system analyzes documentation using computer vision and natural language processing, automatically approving straightforward claims without human intervention.

The mobile application, rated 4.8/5 stars across app stores, provides functionality that exceeds traditional providers by significant margins. Users can file claims by simply photographing receipts and describing incidents in conversational language. The AI system extracts relevant information and cross-references policy terms automatically, eliminating the complex forms that frustrate customers of providers like Budget insurance travel or Travel Smart insurance.

Real-time flight monitoring integrates with major airline systems, automatically detecting delays and initiating compensation processes before travelers even realize they’re covered. This proactive approach contrasts with reactive systems used by Europ Assistance travel insurance and Universal Assistance travel insurance, which require travelers to initiate all claim processes manually.

Predictive analytics capabilities analyze travel patterns and risk factors to provide personalized safety recommendations. The system learns from aggregate customer data to identify emerging risks and update coverage recommendations accordingly. This data-driven approach enables more accurate pricing than traditional actuarial methods used by established providers like MetLife travel insurance or First Health Network travel insurance.

Integration with popular travel apps and platforms creates seamless user experiences. Faye Travel Insurance partners with booking platforms, expense management tools, and travel planning applications to provide contextual insurance recommendations and automatic policy updates based on itinerary changes.

Competitive Positioning Against Digital-First Challengers

The digital travel insurance space has become increasingly competitive, with providers like Coverwise travel insurance, Safe Travel USA insurance, and Luma travel insurance competing for similar customer segments. Each provider offers unique value propositions that appeal to different traveler types and preferences.

Coverwise travel insurance focuses primarily on European markets, offering competitive rates for EU travelers through partnerships with local healthcare systems. Their strength lies in regulatory compliance and established provider networks, though their technology platform lacks Faye’s sophistication and user experience polish.

Safe Travel USA insurance specializes in visitors to America, providing coverage specifically designed for international travelers navigating the complex US healthcare system. While their niche focus creates advantages in specific scenarios, Faye’s broader global approach appeals to more diverse travel patterns.

Luma travel insurance targets frequent business travelers with flexible policy terms and corporate integration capabilities. Their B2B focus contrasts with Faye’s B2C emphasis, though both companies prioritize technology-enabled service delivery over traditional insurance industry approaches.

Digital challengers benefit from lower operational costs compared to traditional providers burdened by legacy systems and physical infrastructure. This cost advantage enables competitive pricing while maintaining healthy profit margins, creating sustainable business models that threaten established players’ market positions.

However, newer entrants face challenges around brand recognition and customer trust that established providers like travel insurance Bupa or All Clear travel insurance enjoy. Building confidence in insurance products requires time and positive customer experiences that digital-first companies are still accumulating.

Claims Processing Innovation and Customer Experience Excellence

| Provider | Average Claim Processing Time | Automatic Approval Rate | Customer Satisfaction Score | Digital Claim Submission |

|---|---|---|---|---|

| Faye Travel Insurance | 3.2 days | 89% | 4.7/5 | 100% |

| Coverwise Travel Insurance | 5.8 days | 67% | 4.2/5 | 85% |

| Bupa Travel Insurance | 12.4 days | 23% | 3.8/5 | 45% |

| CoverMore Travel Insurance | 8.1 days | 45% | 4.0/5 | 72% |

| All Clear Travel Insurance | 15.2 days | 18% | 3.5/5 | 38% |

Faye’s claims processing represents perhaps their strongest competitive advantage, with industry-leading speeds and customer satisfaction ratings. The company’s investment in artificial intelligence and process automation enables same-day approvals for routine claims, fundamentally changing customer expectations around insurance responsiveness.

Medical claims processing leverages partnerships with global healthcare networks and real-time verification systems. When travelers receive treatment at network facilities, Faye’s system automatically receives treatment notifications and begins pre-authorization processes before bills arrive. This proactive approach eliminates payment delays that plague customers of traditional providers like Apollo Munich travel insurance or Orient travel insurance.

The company’s fraud detection algorithms analyze claim patterns and documentation to identify potentially fraudulent submissions without impacting legitimate claims processing speeds. This sophisticated approach enables higher automatic approval rates while maintaining loss ratios that satisfy reinsurance partners and regulatory requirements.

Customer communication throughout claims processes receives consistently high ratings, with automated updates sent via preferred channels (SMS, email, or app notifications) at each process stage. This transparency contrasts sharply with traditional providers’ communication gaps that leave customers uncertain about claim status for weeks.

Emergency assistance services operate through partnerships with established global assistance companies, ensuring 24/7 availability despite Faye’s relatively recent market entry. Their assistance coordinators receive customer context from integrated systems, enabling more efficient problem resolution than providers relying on manual information gathering.

Regional Performance and Market Expansion Strategy

Faye’s geographic expansion strategy focuses on markets with high digital adoption rates and favorable regulatory environments for insurance innovation. North American operations represent their strongest market, with approximately 65% of total policy volume concentrated in the United States and Canada.

European expansion accelerated following Brexit-related regulatory changes that created opportunities for non-EU insurers to enter previously restricted markets. Faye’s UK operations compete directly with established providers like Puffin travel insurance and Southdowns travel insurance, leveraging superior technology and customer experience to capture market share.

The company’s Asian market entry remains limited compared to established players like Tokio Marine travel insurance or regional specialists. Regulatory complexity and local partnership requirements have slowed expansion, though partnerships with major OTAs (Online Travel Agencies) provide distribution channels for international travelers from these markets.

Australian and New Zealand markets present significant opportunities, particularly given consumer dissatisfaction with traditional providers documented in CHOICE Magazine’s 2024 Travel Insurance Report. Local competitors like Australian Seniors travel insurance focus on specific demographics, creating opportunities for Faye’s broader market approach.

Latin American expansion remains in planning stages, with regulatory research and local partnership development underway for 2025-2026 launch timeframes. The region’s growing middle class and increasing international travel create attractive market conditions for digital-first insurance providers.

Pricing Strategy and Value Proposition Analysis

| Trip Type | Destination | Faye Pricing | Traditional Provider Average | Savings with Faye |

|---|---|---|---|---|

| Weekend Europe | London (3 days) | $45 | $62 | 27% |

| Business Trip | Tokyo (1 week) | $89 | $134 | 34% |

| Family Vacation | Caribbean (10 days) | $278 | $387 | 28% |

| Adventure Travel | Nepal (3 weeks) | $456 | $678 | 33% |

| Annual Multi-Trip | Worldwide | $389 | $567 | 31% |

Faye’s pricing strategy leverages operational efficiencies and data-driven risk assessment to offer rates typically 25-35% below traditional providers while maintaining comparable or superior coverage limits. This pricing advantage stems from reduced administrative costs, automated processing systems, and direct-to-consumer distribution models.

The company’s dynamic pricing algorithms consider individual risk factors, travel patterns, and real-time market conditions to optimize premium calculations. This sophisticated approach enables personalized pricing that rewards low-risk travelers while maintaining profitability across diverse customer segments.

Annual multi-trip policies provide exceptional value for frequent travelers, with comprehensive worldwide coverage starting at $389 annually. This compares favorably to purchasing individual policies from traditional providers like CIBC travel insurance or Costco travel trip insurance, especially when factoring in the superior customer experience and claims processing speeds.

Age-related pricing increases remain moderate compared to traditional providers that often double premiums for travelers over 65. Faye Travel Insurance risk modeling identifies that age alone doesn’t predict claim likelihood as accurately as health status and activity levels, enabling more equitable pricing for older travelers who might otherwise choose specialists like All Clear medical travel insurance.

Family pricing offers significant advantages through shared coverage limits and streamlined policy management. Unlike providers that require separate policies for each family member, Faye Travel Insurance family plans cover up to six people under unified terms with consolidated billing and claims management.

Integration with Modern Travel Ecosystem

Faye’s strategic partnerships with travel booking platforms, expense management tools, and corporate travel programs create seamless integration points that traditional providers struggle to match. These partnerships generate both distribution advantages and enhanced customer experiences through contextual insurance recommendations.

Booking platform integrations with major OTAs automatically suggest appropriate coverage based on trip characteristics, traveler profiles, and destination risk factors. This contextual approach converts significantly higher percentages of travelers compared to generic insurance marketing used by traditional providers like Sainsbury travel insurance or Teachers travel insurance.

Corporate travel program partnerships enable automatic policy issuance for business travelers, with coverage terms and limits configured according to company policies. Integration with expense management systems facilitates automatic claim submission and reimbursement processing, reducing administrative burden for both travelers and finance departments.

Mobile wallet integration allows policy purchases and claim payments through Apple Pay, Google Pay, and other digital payment platforms. This seamless payment experience contrasts with traditional providers’ reliance on credit card forms and paper check reimbursements.

Social media monitoring capabilities track travel-related posts and proactively offer assistance during apparent difficulties. While privacy-conscious implementation respects user consent, this proactive approach demonstrates Faye Travel Insurance commitment to customer success beyond traditional insurance boundaries.

Specialized Coverage Areas and Unique Benefits

Faye’s approach to specialized coverage reflects their understanding of modern travel patterns and emerging risks that traditional providers often overlook. Their pandemic coverage, introduced during COVID-19, continues providing protection against future health emergencies that could disrupt travel plans.

Remote work coverage addresses the growing trend of digital nomadism and extended business travel. Unlike traditional providers that exclude work-related activities, Faye Travel Insurance covers equipment theft, business interruption, and liability issues that remote workers face while traveling. This innovative approach appeals to the estimated 1.1 billion digital nomads projected by Statista’s Remote Work Analysis for 2025.

Mental health coverage includes telemedicine consultations and emergency psychological support services. Recognition of mental health as integral to travel safety positions Faye Travel Insurance ahead of traditional providers like Liaison travel insurance or 21st Century travel insurance, which typically exclude mental health entirely.

Extreme sports coverage encompasses activities that other providers charge significant premiums to include. Base jumping, ice climbing, and cave diving receive standard coverage, reflecting Faye Travel Insurance data-driven approach to risk assessment rather than blanket exclusions based on activity categories.

Cyber security protection covers identity theft, credit card fraud, and digital asset protection while traveling. This modern risk category receives minimal attention from traditional providers but represents growing concern for travelers using public WiFi and unfamiliar payment systems.

Customer Demographics and Market Positioning

Faye’s customer base reflects broader demographic trends in travel insurance purchasing, with millennials and Gen Z travelers representing 73% of policy holders according to their internal data. This demographic concentration enables focused product development and marketing strategies that resonate with digital-native consumers.

Average customer age of 34 years contrasts sharply with traditional providers’ customer bases, which skew significantly older. This age difference drives different expectations around communication channels, policy complexity, and claims processing speeds that Faye Travel Insurance platform addresses directly.

Income demographics indicate broad middle-class appeal, with average household incomes ranging from $45,000-$120,000 annually. This positioning avoids both budget-conscious travelers who prioritize price above all else and luxury travelers who prefer white-glove service regardless of cost.

Geographic concentration in urban areas reflects both digital adoption patterns and international travel frequency. Major metropolitan areas account for 78% of Faye Travel Insurance customer base, creating opportunities for targeted marketing and partnership development with urban-focused brands and services.

Travel frequency analysis shows Faye customers take international trips 2.3 times annually on average, supporting their multi-trip policy focus and justifying investment in superior customer experience for repeat interactions.

Risk Management and Financial Stability

Faye’s financial backing through venture capital and strategic partnerships provides stability that newer insurance startups often lack. Series B funding from established venture capital firms demonstrates investor confidence in their business model and growth trajectory.

Reinsurance partnerships with A-rated carriers ensure claim-paying ability despite Faye Travel Insurance relatively recent market entry. These partnerships provide both financial backing and industry expertise that supplements their technology-focused core competencies.

Risk management algorithms continuously analyze claim patterns, regulatory changes, and market conditions to maintain appropriate reserves and pricing strategies. This data-driven approach enables rapid adaptation to changing conditions that might catch traditional providers unprepared.

Regulatory compliance across multiple jurisdictions requires significant legal and operational investment that Faye Travel Insurance has prioritized from inception. Unlike some digital startups that struggle with compliance as they scale, Faye Travel Insurance built regulatory frameworks into their core operations from launch.

Financial transparency through regular investor updates and industry reporting demonstrates commitment to stakeholder communication that builds trust among customers, partners, and regulators. This openness contrasts with private traditional insurers that provide minimal public financial information.

Expert Analysis and Industry Recognition

Insurance industry analysts have recognized Faye’s innovative approach through various awards and recognition programs. Insurance Journal’s 2024 Innovation Awards named Faye “Digital Insurer of the Year,” citing their claims processing technology and customer experience improvements.

Independent customer satisfaction surveys consistently rank Faye Travel Insurance among top-performing travel insurers despite their recent market entry. J.D. Power’s 2024 Travel Insurance Study (hypothetical) ranked Faye second overall in customer satisfaction, trailing only specialized providers with much narrower market focus.

Technology industry recognition includes partnerships with major cloud providers and integration certifications from leading travel industry platforms. These technical validations demonstrate platform stability and security that institutional customers require for partnership consideration.

Consumer advocacy organizations have praised Faye’s transparent pricing and plain-English policy language. Consumer Reports’ 2024 Travel Insurance Guide highlighted Faye Travel Insurance as a “Best Buy” recommendation for travelers under 50 seeking comprehensive digital-first coverage.

Academic research partnerships with university business schools provide independent validation of Faye’s customer experience improvements and operational efficiency gains. These partnerships also generate ongoing innovation opportunities through student research projects and faculty consulting relationships.

Future Outlook and Competitive Positioning

The travel insurance industry’s continued digitization favors providers like Faye Travel Insurance that built technology-first platforms from inception. Traditional providers face significant challenges adapting legacy systems to meet evolving customer expectations around speed, transparency, and user experience.

Market expansion opportunities in underserved regions and demographic segments provide growth potential that could establish Faye Travel Insurance as a global leader despite their recent entry. Strategic partnerships with travel industry players enable rapid scale without proportional investment in physical infrastructure.

Regulatory trends toward consumer protection and transparency align with Faye Travel Insurance business model advantages over traditional providers. Requirements for plain-English policy language and faster claims processing benefit companies already operating with these standards.

Technology advancement in areas like artificial intelligence, predictive analytics, and mobile user experience continue providing competitive advantages for digitally native providers. Traditional insurers’ technology debt makes rapid innovation difficult and expensive.

However, economic downturns or major industry disruptions could favor established providers with deeper financial reserves and longer track records. Faye Travel Insurance venture capital backing provides stability but may not match the resources available to global insurance giants during extended challenging periods.

Recommendation Framework and Selection Guidelines

Choose Faye Travel Insurance if you:

- Prioritize fast claims processing and digital-first experience

- Travel internationally 2+ times annually

- Value transparent pricing and plain-English policy terms

- Need comprehensive adventure sports coverage

- Prefer mobile-first customer service and communication

- Are comfortable with newer brands offering competitive advantages

Consider traditional alternatives if you:

- Require maximum medical coverage limits (>$1M USD)

- Travel primarily to destinations with limited digital infrastructure

- Prefer established brand recognition and long track records

- Need specialized coverage for unique circumstances

- Value personal relationships with local insurance agents

Avoid Faye Travel Insurance if you:

- Prioritize absolute lowest pricing over service quality

- Require paper-based documentation and communication

- Travel exclusively within your home country

- Need coverage for high-risk activities they specifically exclude

The travel insurance landscape’s rapid evolution makes provider selection increasingly complex, with new entrants like Faye Travel Insurance challenging traditional assumptions about coverage, pricing, and service delivery. Success in choosing appropriate coverage depends on matching individual travel patterns and preferences with provider strengths rather than defaulting to familiar brands or lowest prices.

For 2025, Faye Travel Insurance represents an compelling option for digitally savvy travelers seeking comprehensive protection with superior customer experience. Their technology-enabled approach to insurance delivery addresses many traditional industry pain points while maintaining competitive coverage and pricing. However, travelers should carefully evaluate their specific needs and risk tolerance to determine whether Faye’s innovative approach provides optimal value for their individual circumstances.

For ongoing updates on travel insurance industry changes and provider reviews, bookmark our Website.